ipopba

Edwards Lifesciences Corp (NYSE:EW) is a proven, high quality business with long-term tailwinds. Despite this, the stock is down about 40% from its peak in early 2022. This drop can be attributed to short-term growth concerns and subsequent multiple compression. These short-term concerns are not unwarranted; growth has declined quite a bit in the most recent quarters due to hospital staffing shortages that have created bottlenecks in the application of Edwards products.

Demand however, is not an issue. The main driver of the business, transcatheter aortic valve replacement (TAVR), has seen sustainably high demand for many years. TAVR is a minimally invasive procedure to fix thickened aortic valves, an unfortunately prevalent issue around the world. TAVR, along with the other products Edwards offers, will continue to sustain demand for many years to come.

Coupled with these demand tailwinds, Edwards has an excellent financial profile, a history of organic growth as opposed to growth via M&A, and a history of returning cash to shareholders. After the selloff of the past year, the stock has a reasonable valuation that leads me to believe investors can achieve a 12.5% IRR over the next 5 years with an investment today. I will discuss these points and my forecast in detail below, and I will compare Edwards to the software company Adobe (ADBE). I make this comparison to further show that the valuation is reasonable and that Edwards is, in my opinion, a better investment than even a best-in-class software company.

Financial History

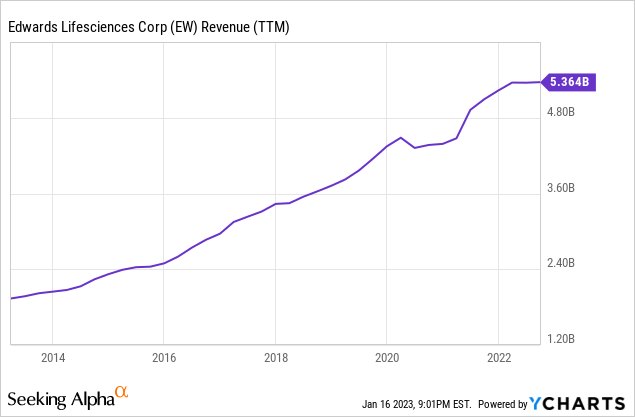

Edwards is a high quality compounder. Since 2012 revenue has grown at a 12% CAGR and EBIT has grown at a 16% CAGR. What’s most impressive about this is that the vast majority of this growth has happened through organic growth and product development via R&D. Most acquisitions are small, tuck-in acquisitions so Edwards has not spent much on M&A over the years.

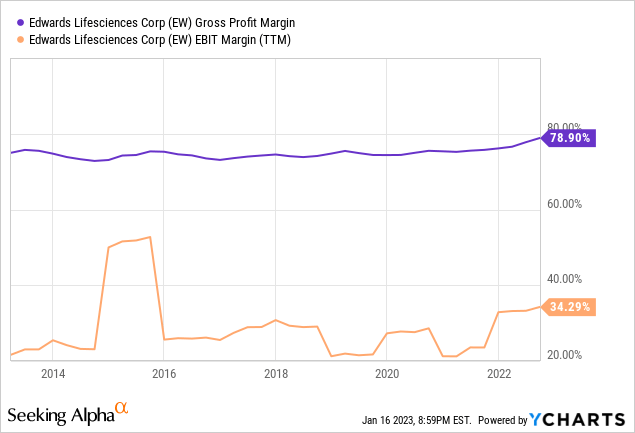

Edwards margins are software-like. Gross margin is currently around 76% while operating margin is around 31%. Margins have also consistently grown over time which demonstrates pricing power and operating leverage. These high margins lead to strong cash flows and because Edwards does not spend much on M&A, they have a history of returning cash to shareholders via share repurchases. Since 2012 the share count has declined at a CAGR of 1.3%.

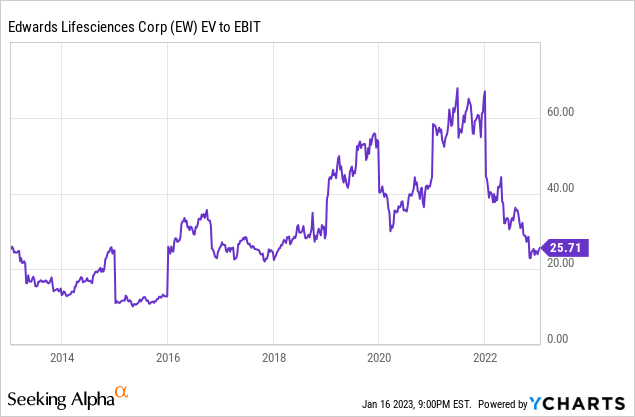

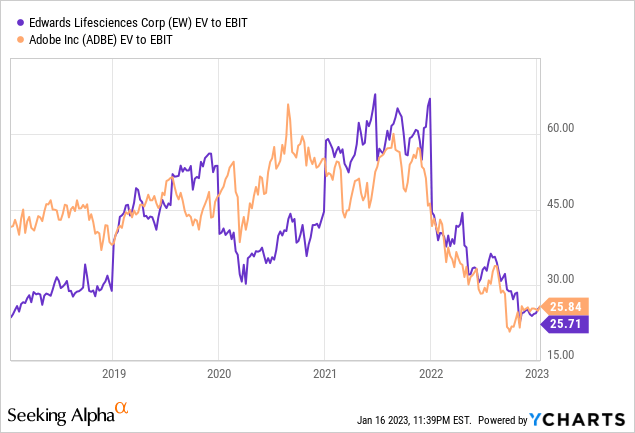

These financials paint the picture of an excellent business. It has consistent organic growth, high and rising margins, low capital intensity (although R&D should be considered a capital expenditure as it is spending for growth many years into the future), and a declining share count. For these reasons, the stock commands a high earnings multiple. It’s currently trading at about 27 times TTM EBIT but at its peak in early 2022 it traded at about 60 times TTM EBIT.

As I was looking into these financials I was reminded of Adobe and I thought it would be a good exercise to compare Edwards to a best-in-class software company that many great investors, such as Bill Nygren, are bullish on.

Adobe Comparison

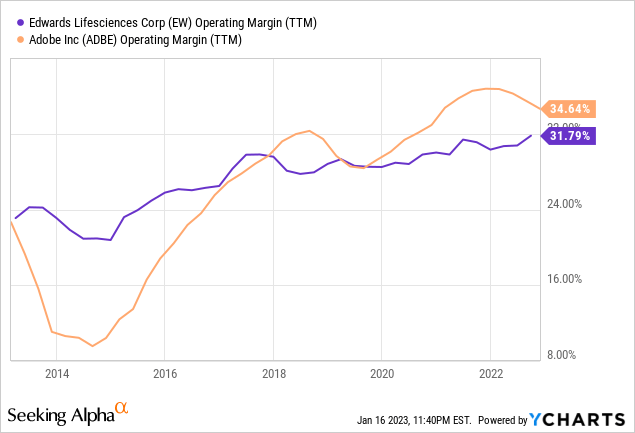

Adobe has a higher gross margin than Edwards but a similar operating margin. Adobe’s gross margin is ~90% while its operating margin ranges from 30-35%. Edwards margins are currently about 76% and 32% respectively. Adobe’s revenue has grown at a 15% CAGR over the past 10 years versus Edwards’ 12% revenue CAGR. So topline growth has been higher on average but some of the growth can be explained by acquisitions as Adobe’s cash used for acquisitions is often equal to significant percentage of revenue for the year. For example, in 2018 Adobe spent $6 billion cash or 66% of revenue on acquisitions, $2.5 billion or 17% of revenue in 2021, and most recently acquired Figma for $20 billion, which is about 50x Figma’s annual recurring revenue.

Despite Adobe’s history of higher revenue growth, both Adobe and Edwards are guiding for about 10% revenue growth in 2023.

Adobe’s share count has declined at a similar rate as Edward’s share count. Adobe’s diluted share count has declined at a 0.5% CAGR from 502 million to 470 million while Edwards has declined at a 1.3% CAGR from 709 million to 631 million since 2012. Even though Adobe’s share count has declined, most recently, Adobe’s stock based comp has equaled about 6% of revenue, while it is about 2% of revenue for Edwards. Both also hold a small amount of debt but both are comfortably in a net cash position.

Coincidentally, both are currently trading at about 26 times TTM EBIT and the multiples have generally been similar over time.

In summary, both companies have similar and rising EBIT margins, both companies are guiding for about 10% revenue growth in 2023, both have share counts that are declining at close to the same rate, both use minimal amounts of debt, and both are trading at the same TTM EBIT multiple.

With these similarities in mind, I would choose to invest in Edwards over Adobe (I do in fact have a long position in Edwards stock). The main reason for this preference is the focus on organic growth at Edwards versus M&A. I like that Edwards sees clear tailwinds for its products and plays offense by spending a large percentage of its revenue on R&D which I expect will have high returns over time. I don’t like that Adobe consistently spends billions on acquisitions and seems to be playing defense by acquiring competitors with huge price tags (i.e. acquiring Figma for $20 billion, or 50 times annual recurring revenue). That acquisition may prove to be a smart move over time but I have more confidence that Edwards’ return on R&D spend will be higher than the return on acquisitions with that type of valuation.

| Adobe | Edwards | |

| Revenue CAGR (2012-2021) | 15% | 12% |

| Gross Margin (2021) | 90% | 76% |

| EBIT Margin (2021) | 35% | 31% |

| Share Count CAGR (2012-2021) | (0.5%) | (1.3%) |

| Net Debt | ($1.1 billion) | ($776 million) |

| EV/EBIT Ratio (TTM) | 26 | 26 |

This exercise of examining similarities provides a layer of confidence to an investment in Edwards, as Adobe is a very high quality company that may see solid returns going forward.

Forecast

Having established that I think Edwards is a high quality business, I will keep this forecast simple by extrapolating past growth rates while considering comments and guidance from the management team.

Through 2027, I will assume a 10% revenue growth per year. Given the past growth rate, tailwinds, and management’s guidance for 9-12% revenue growth in 2023, this feels like a reasonable assumption. This growth rate would lead to 2028 revenue of $8.35 billion.

I will assume a 34% operating margin in 2027. Operating margin has increased over time and will continue to increase from the 31% operating margin today as both G&A and R&D leverage increase.

I will assume debt and cash are equal in 2027.

Finally I will use a 30x EV/EBIT ratio for the final enterprise value. A 30 EV/EBIT ratio has been the average of the past 10 years for the stock and compared to the current 26 times EBIT multiple for the stock, I am assuming slight multiple expansion. Considering the higher operating margin I am assuming plus the consistent growth rate, I think this is a fair multiple to apply to the stock for 2027.

Bringing it together, this forecast assumes $2.84 billion of EBIT in 2027. With a 30x multiple, the enterprise value would be $93.6 billion which would be a 12.5% IRR over the next 5 years if the stock was purchased today.

Risks

The biggest risk is if hospital staffing shortages persist. This is why 2022 revenue growth declined and could cause revenue growth to remain below 10%. This would seriously lower the expected IRR of my forecast.

The staffing shortages lead to lower growth because applying TAVR treatment or any other Edwards products to treat patients requires multiple tests, multiple visits to the hospital and hospital space to monitor patients. With staffing shortages, hospitals simply don’t have the capacity to get this done.

Although the shortage is especially exacerbated today due to fallout from the pandemic, the nursing and hospital staff shortage has been a persistent issue over time. In the U.S., there was a shortage in the 40s that persisted through the 60s, there was a nursing shortage in the 90s, the issue was apparent in 2015, and there was a nursing crisis in 2017.

I’m not trying to downplay the severity of this issue, it needs to be addressed and resolved, I’m just trying to make the point that the healthcare sector has grown despite it and more specifically, Edwards has grown despite these issues. People are sick and need Edwards’ products to improve their conditions. At the same time, hospitals want to make money and will do so by treating patients with products like those from Edwards. When there is a will, there is a way and I believe that the healthcare sector, like it has consistently done over time, will find ways to improve the staffing shortage or work around it in order treat sick patients.

Final Thoughts

I’m clearly not an expert on heart disease treatments, but it’s easy to tell from the financials that Edwards is a high quality business that offers high quality treatments. Organic revenue growth has been solid and steady over time, indicating strong and steady demand. Gross margin and operating margin are both high and rising, indicating pricing power and operating leverage. And we know that cash is being returned to shareholders as the share count is declining steadily over time.

The high quality nature of the business is also clear through a comparison to a best-in-class software company such as Adobe. You can find more details of this comparison in the article above but in short, Adobe’s margin profile, capital structure, and expected future growth rate are all quite similar to that of Edwards. I think this shows that both companies are of similar quality and as such, both currently command a 26-27x LTM EBIT multiple.

While the quality is evident, short term worries over growth have led the stock price to decline from an elevated EBIT multiple that we saw in early 2022. Now that the multiple has compressed, I see an investment today potentially generating a 12.5% IRR given the assumptions that I outline above. The biggest risk to this forecast is the hospital staffing shortages that are ongoing but over the past century, there have been many nurse and hospital staff shortages. Being in a constant state of staffing shortages is not a good way to have a solid healthcare system but it has not stopped the healthcare system from growing and more specifically, it has not stopped Edwards from growing. I don’t think this will change meaningfully going forward.