Dish Network ended 2022 with some of the most downer data the U.S. pay TV business has ever seen, losing another 191,000 satellite TV customers and 77,000 virtual Sling TV subscribers in the final three months of the year.

Dish, which won’t formally announce Q4 earnings until sometime next month, made the disclosure in an SEC filing Tuesday, in conjunction with the revelation of a $500 million secured debt offering.

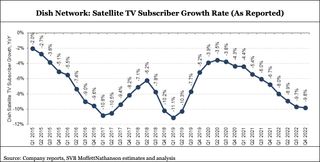

While the nominal rate of decline for Dish satellite didn’t increase — the company bled 203,000 satellite customers in the fourth quarter of 2021 — the overall erosion rate reached a record 9.8%, usurping the 9.7% bleed rate in Q3 and the 8.9% erosion experienced in the second quarter.

As equity research company MoffettNathanson noted, Dish satellite’s remaining base of just over 7.4 million subscribers is about a third of its peak 2009 size.

Meanwhile, Sling TV’s remaining base of 2.334 million subscribers puts its size roughly where it stood in early 2018, just three years after launch. It’s losses, combined with Dish satellite, put Dish’s total pay TV erosion in the fourth quarter at 8.9%.

Dish is the fourth largest pay TV company in the U.S., based on subscriber reach. Its customer bleed rate approached No. 1 pay TV company Comcast in 2022 — Comcast lost customers at a rate exceeding 10%.

The losses, which accompany another 24,000 customer defections for Dish’s Boost Mobile MVNO-based retail wireless business, aren’t shocking. But their pace of decline is concerning for a telecom that’s in a race against time — and acquired capital resources — to build out its own wireless network, as agreed to under federal consent decree.

As was also stated in Tuesday’s SEC filing, Dish broke ground on its target of 15,000 microcells, with the expectation that those cells will cover 60% of the U.S. population.

Over the next two years, as Dish looks to fund this pricy buildout, analyst Craig Moffett noted Tuesday, investors are probably in for a wild ride.

“While they have used debt thus far, there is a growing expectation that their convertibles will need to be equitized, resulting in meaningful equity dilution,” Moffett wrote.