Santiaga

We believe Adobe, Inc (NASDAQ:ADBE) is currently trading about 9% higher than its intrinsic value but still rate it a Buy. Adobe is an outstanding business and enjoys a strong network effect, remarkably more than 400 billion PDFs were opened in Adobe products in the last year. The network effect is seldom used in traditional value assessments of companies but is very relevant for a software company that is dependent on growing and retaining subscriptions. More use of its products makes Adobe more resilient in the face of competition and uncertainty. For these reasons, we are comfortable paying a 9% premium to intrinsic value in exchange for a strong moat. However, the closer Adobe’s price is to our estimated fair value of $315.58, the more attractive this is as an investment.

Overview

Adobe is a software company that provides digital media and experience applications, products, and services, most notably Adobe Acrobat PDF Viewer and Adobe Photoshop. They are the 13th largest company by market cap in the Information Technology sector as of January 16th, 2022.

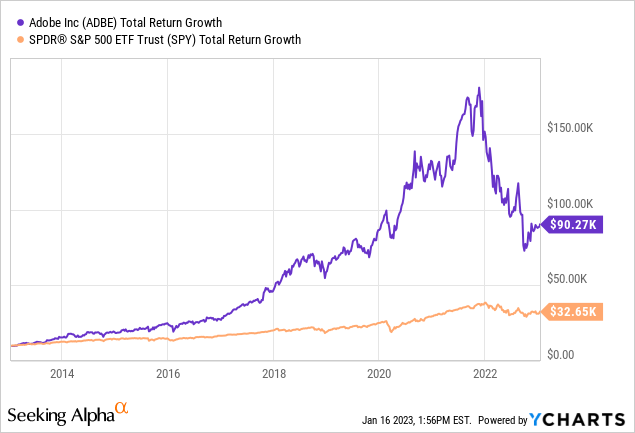

A $10,000 investment in ADBE on January 15th, 2013 would be worth $90,270 today, nearly tripling the return of the S&P 500 over the same period:

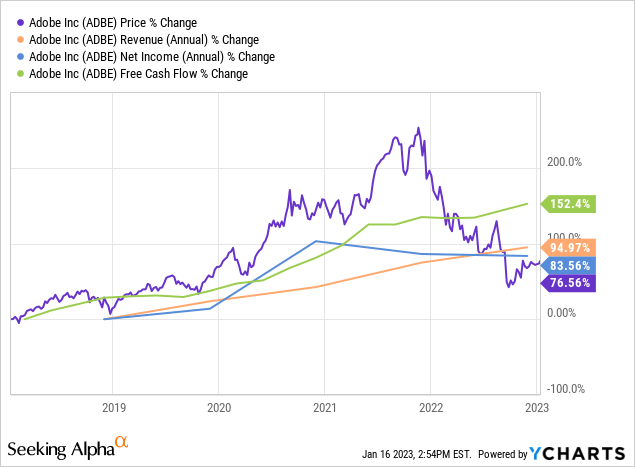

The comparison of Adobe’s price and underlying financials also shows strong fundamental growth with particular strength in cash flow growth over the past 5 years:

Adobe’s free cash flow yield of 4.19% forms our minimum expected compounded yearly return, currently above the risk-free rate. For this article, we consider the risk-free rate to be 3.61%, which is the 10-year T-bill rate at the time of writing. In other words, we believe the minimum return for Adobe (with a sufficiently long time horizon) is 4.19%, beating the risk-free rate. Clearly, this company is deserving of further evaluation and discussion.

Adobe’s Market Position

Adobe is the largest application software company by market cap and a clear market leader. Adobe revolutionized two major industries with their products Photoshop and the PDF file. ‘Photoshopping’ is now synonymous with the concept of photo editing. Per Statista, Adobe’s brand is worth $92.8B at a current market cap of $160B. Compared to Apple ($947B brand value, $2.13T market cap), Google ($766B brand value, $1.2T market cap), and Microsoft ($611.5B brand value, $1.78T market cap), Adobe’s brand is worth more relative to their market cap than Apple and Microsoft. Being second only to Google in a measure of brand value is admirable in its own right. Adobe was a market leader and forward-thinker with previous product offerings and has built a moat based on product expertise and a loyal, growing customer base. They hope to maintain their track record of forward-thinking management with their recent shift to being completely cloud-based. Being cloud-based offers a number of benefits and works well with the subscription-based revenue model.

The strength of Adobe’s existing moat is likely to widen from its shift to the Cloud and the growing network effect of the Adobe ecosystem. Adobe is poised to benefit from organic market growth as more businesses pursue digital transformation. The broad-based transition to digital solutions was catapulted forward by COVID-19. Adobe Acrobat, the PDF viewer, provides seamless PDF functionalities and capabilities. Acrobat provides a lot of metadata which helps firms automate and digitize their business. Adobe has a key competitive advantage with its positioning in a growing B2B SaaS and software market that should provide sustainable, sticky revenue growth amidst the broad-based digital transformation. Adobe has numerous opportunities to continue strengthening its brand and growing revenues. Adobe has made a number of sizable acquisitions in recent years and continues to focus on user growth and strong retention rates. The strategy set by management has been successful and looks positioned to continue delivering value.

According to their 4th quarter earnings, Adobe enjoyed 15% year-over-year growth in revenue, reaching $17.61B, and hit their first $1B subscription revenue quarter in the Digital Experience business. The Digital Media segment, which made up 73% of total revenue in 2021, had its best quarter ever in net new subscription revenue with $576M. Adobe is a titan in the software industry and is poised to benefit from the widespread adoption of cloud-based services, which gives us a resounding belief that Adobe is an outstanding business with highly competent management. A look at the return on assets and return on equity, 17.51% and 33.85% respectively, confirms Adobe’s strong compounding potential. We believe Adobe’s strong brand in its Digital Media segment and the organic growth of key industries in the digital experience make it an outstanding business. Organic growth and competent management will allow Adobe to continue growing and thriving in the future.

Competition and Risks

Adobes faces a number of key competitors across the software industry. Apple and Adobe have a history regarding the issue of Flash usage on Apple products. The Adobe Experience Cloud competes with Salesforce in the customer relationship management (CRM) space. Customer relationship management software brings comprehensive marketing capabilities to firms. Adobe’s offering includes (but is not limited to) Adobe Experience Manager (AEM) and Adobe Analytics. There are also a number of APIs available from Adobe and Salesforce that can help businesses enhance the customer experience throughout their customer and product lifecycles. Microsoft is another competitor with its Dynamics product, which is a line of applications for enterprise resource planning and customer relationship management. This space is rapidly growing and is being revolutionized by the development of artificial intelligence and machine learning.

Adobe’s products are widely used and there are considerable cybersecurity risks presented. Adobe Flash and PDF are among the top applications in terms of cyberattacks, although far behind Microsoft Office with 70% of all attacks. Flaws and bugs in Adobe’s software can lead to an erosion of market share. If Adobe is unable to improve product safety and value-added, customers may turn toward applications with better features. Intense competition across the whole software industry is a key business risk. Adobe needs to continue innovating and improving its product offerings to retain its strong brand value and market share.

Valuation

Using a free cash flow to equity valuation yields a valuation of $146.71B, or $315.58 per share. By this measure, Adobe is currently overvalued by 9.13%.

|

Free Cash Flow to Equity Valuation |

|

|

2022 Free cash flow |

$5,941,800,000.00 |

|

Free cash flow growth |

14.00% |

|

Projected 2023 Free cash flow |

$6,773,652,000.00 |

|

Risk-free rate |

3.61% |

|

Adjusted beta |

1.15 |

|

Market risk premium |

5.02% |

|

Required return on Equity |

9.38% |

|

Shares outstanding |

464,900,000 |

|

Total Equity Value |

$146,711,111,111.11 |

|

Equity value per share |

$315.58 |

For the free cash flow numbers, we used levered free cash flow to incorporate the debt burden. We found the compounded annual growth rate of the levered free cash flow since 2014 and used that to estimate 2023 free cash flow. It’s worth noting that we used adjusted beta, which fixes the mean-reverting tendency of beta. The standard beta we found was 1.24, which changes the valuation to $162B and $349.81 per share. According to the standard beta, Adobe is actually undervalued currently and is a Strong Buy. For market risk premium, we used this CAGR Calculator and used those values to find the total equity value, or projected free cash flow / (free cash flow growth rate – required return on equity).

Conclusion

We believe Adobe is a very strong, albeit somewhat overvalued, company that deserves your attention. This is a company with a proven track record, an immense ecosystem, and market-leading product offerings across a variety of software sub-sectors. Adobe is a titan of the tech industry but doesn’t get nearly the attention of the largest tech names. We believe Adobe is as close to a ‘boring’ company as you can find in tech, and feel Adobe will deliver strong returns in the future.