South_agency/E+ via Getty Images

Introduction

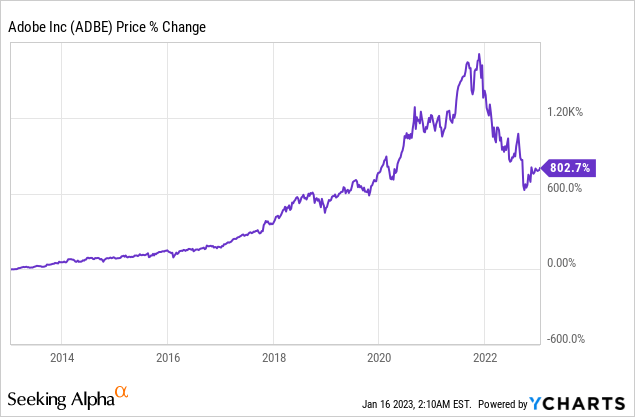

Adobe (NASDAQ:ADBE), a leading software company known for its creative tools such as Photoshop and Illustrator, has been an exceptionally strong performer in the stock market over the past decade.

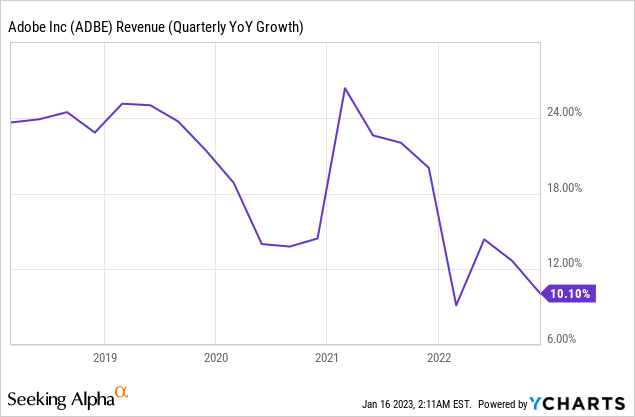

But clearly, 2022 was not a great year for Adobe.

Their stock was punished as investors fled technology stocks to value stocks with shorter duration cash-flows. Adobe was especially hard hit by investors on fears of a slowdown of revenue growth.

Prior to the slowdown Adobe has consistently reported strong financial results, thanks to its subscription-based business model and its focus on digital media and creative software.

Recently, perhaps in an effort to reignite growth, Adobe announced its acquisition of Figma, a popular cloud-based design and collaboration platform. This acquisition is a strategic move for Adobe as it looks to expand its offerings in the growing field of design and collaboration.

In this article, we will discuss the financial performance of Adobe, the reasons behind its success, and the potential impact of the Figma acquisition on the company’s future growth prospects, and what I think a fair price is to pay for investors.

Operations

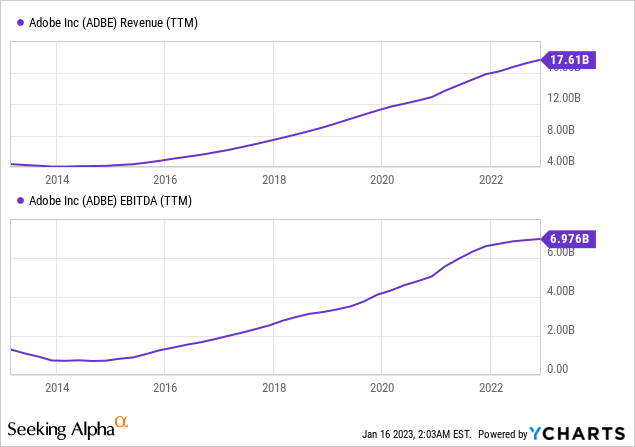

Other than the recent slowdown, Adobe’s revenue has grown consistently over the last several years, driven by strong demand for its Creative Cloud and Document Cloud offerings.

As I have written about previously, the company’s subscription-based business model has been a key driver of its financial success, as it has allowed Adobe to shift away from a traditional one-time software sales model to a recurring revenue stream. This has resulted in a more predictable and stable revenue stream for the company.

Adobe’s strong financial performance has also been driven by its focus on digital media and creative software. The company’s tools are widely used in a variety of industries, including advertising, entertainment, and e-commerce.

As the world becomes increasingly digital and the creator economy continues to grow, the demand for Adobe’s products is likely to continue to grow too.

Creator Economy

The so-called “creator economy”, which refers to the growing number of creators who are making a living from online content, has been on the rise in recent years. Examples of these platforms include YouTube, TikTok, Twitch, Fiverr, and online bloggers.

Seeking Alpha itself may be considered an example of the creator economy.

The growth of the creator economy is driven by several factors, including the increasing availability of digital tools and platforms that enable creators to easily create, share and monetize their content.

Tools such as Photoshop, and Premiere!

The rise of social media, streaming platforms, and marketplaces have made it easier for creators to reach a global audience, and monetize their content through advertising, sponsorships, and direct financial support from fans.

According to research commissioned by Meta (META) The creator economy is forecasted by some exploratory studies to reach more than $100 billion! I’d encourage you to read the entire report which can be found here if you’re curious to get a better understanding of just how much of a game-changer the creator economy may be.

In my opinion, owning Adobe is one of the best ways to get exposure to the growing creator economy.

Platforms like YouTube (GOOG) and Instagram are at risk of becoming disintermediated by new platforms like ByteDance’s TikTok. Adobe serves as the platform-neutral “picks and shovels” play in this creator economy gold rush.

Financials

Unsurprisingly, given the widespread use of its products and notorious growth, Adobe has what I consider to be some of the best financial statements of any public company.

Revenue and EBITDA Growth

As you can see in the chart above, Adobe has been a consistent performer in the realm of revenue growth and EBITDA growth. Its subscription model and exposure to the creator economy most certainly helped here.

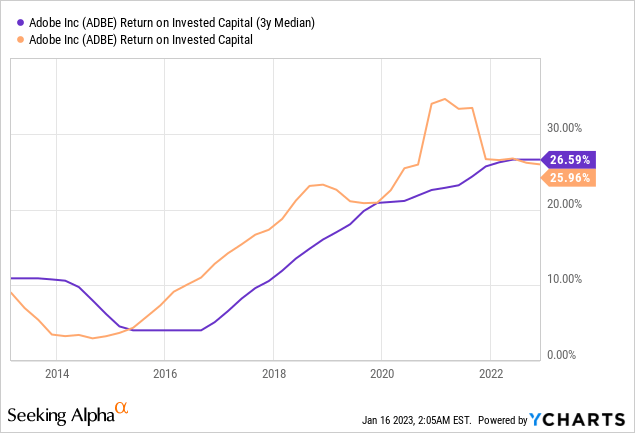

Return on Invested Capital

What is perhaps even more impressive has been their returns on invested capital which now stand at 26%, having improved significantly over the past decade!

As companies mature we might expect returns on invested capital to decline as they begin to run out of accretive projects to deploy capital towards. This has not been the case with Adobe, which has seemingly bucked that trend having catapulted to new highs.

I believe that companies that can sustain high returns on capital over a long period of time are often superior investments to others. Adobe seems to boast this trait.

Risks

Despite Adobe’s strong financial performance, there are still some risks that investors should be aware of.

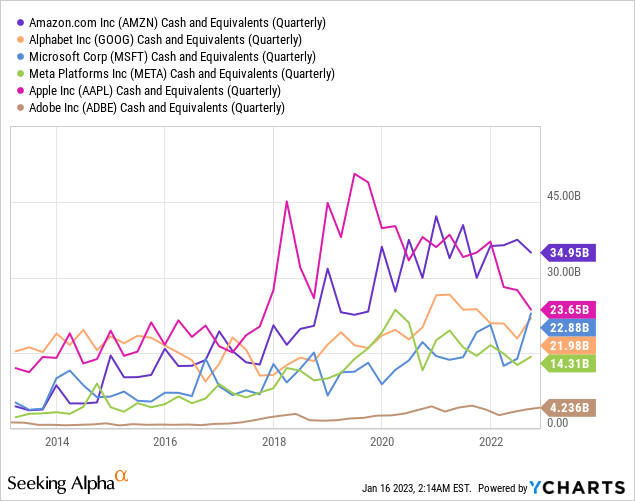

Big-Tech Competition: One of the main risks for Adobe is the potential for increased competition in the design and collaboration space. Tech companies, such as Microsoft (MSFT) and Google (GOOG), are also investing in design and collaboration tools, which could increase competition for Adobe as their product offerings increasingly overlap.

As big tech companies look to diversify revenue streams, I would expect this trend to continue, with big-tech competing head-on with each other in more areas and with other firms like Adobe.

They sure have the capital to try.

Freemium Competition: Adobe’s business model also relies heavily on a subscription-based revenue stream which could be affected by an increase in the number of free or low-cost alternatives in the market.

Adobe’s pricing strategy is relatively high compared to competitors, which might discourage some users to adopt their software.

Tools like GIMP and Luminar compete directly with photoshop, offering a limited number of features at significantly reduced prices, or in some cases, at no cost whatsoever.

Valuation

To value Adobe I employed two methods a discounted cash flow analysis and a comparison of forward PE ratios to some of the limited number of peers they have.

| Company | Current Stock Price | EPS 2023 Est. | 2023 P/E |

| ADBE | $344 | $15.32 | 22.5 |

| (BSY) | $38 | $0.89 | 42.7 |

| (ANSS) | $254 | $8.40 | 30.3 |

| ETR:NEM | $59 | $1.60 | 36.8 |

| Average PE (excl. ADBE) | 36.6 |

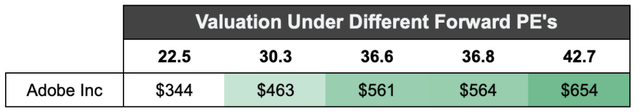

Applying those different PE ratios to Adobe’s earnings yielded the following result:

Forward PE Comparison (Authors Calculations, Analyst Estimates)

The result was initially quite optimistic, but there is likely a strong degree of selection bias impacting the results here as Adobe is much larger than any of the peers mentioned, and it’s growing more slowly.

I will take these results with a grain of salt.

To get a better sense of Adobe’s valuation I performed a discounted cash flow analysis on the company. Some of the assumptions I made include a 9% discount rate, 13% revenue growth through 2029 (up from my last valuation of 11%), and a 2% terminal growth rate. And 100% NI to FCF conversion.

| Year | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Revenue | $17,606.0 | $19,260.0 | $21,560.0 | $24,362.8 | $27,530.0 |

| Net Income | $5,811.3 | $7,066.5 | $8,228.7 | $9,298.5 | $10,507.3 |

| Cash Flow | $5,230.1 | $7,066.5 | $8,228.7 | $9,298.5 | $10,507.3 |

The model implies the intrinsic value of one share of Adobe is ~$391, this is quite a bit higher than where shares trade today ($344 at the time of writing).

At $391 adobe would trade at a forward PE of 25.5 which still compares quite favorably to its peers.

Conclusion

In conclusion, Adobe has been a strong performer in the stock market, fueled by a consistent history of growth driven by its subscription-based business model and focus on digital media and creative software.

The growth of the creator economy presents a significant opportunity for Adobe, and the company has been positioning itself to benefit from this trend.

The company’s financial performance has been robust, and its strong revenue growth and profitability are a testament to its effectiveness. Sustained double-digit returns on capital invested make me optimistic about the future of Adobe.

This is Adobe’s game to lose.

I rate Adobe a buy with a 1-yr price target of $391.